The Nifty50 closed the week ended March 20 with losses of over 12 percent, while a bigger carnage was seen in the broader market space.

Tracking the volatility in the market, which has so far eroded more than Rs 20 lakh crore in terms of market capitalisation on the BSE, SEBI introduced a few measures to curb volatility.

India’s volatility index (India VIX) shot up to levels that were last seen during the aftermath of the 2008 financial crisis — closing at 67.10 on Friday.

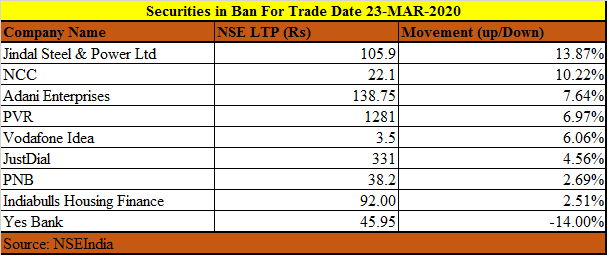

NSE has placed 9 securities in the F&O ban period — JSPL, NCC, Adani Enterprises, PVR, Vodafone Idea, JustDial, PNB, Indiabulls Housing Finance, and Yes Bank.

Short-selling in these stocks in the ban period will become slightly difficult.

The move is aimed at reducing the volatility in the market as it could curb short-selling both in the F&O as well as the cash segment.

Short-selling is a practice where traders/investors sell stocks in the hope of buying it at a lower price.

SEBI restricted the extent of short-selling of index derivatives by mutual funds, foreign portfolio investors and proprietary traders. The regulator also introduced margins in the cash market on stocks that are part of the F&O list and even on stocks that are not part of the list.

According to a SEBI circular, short-selling is the sale of a security that the seller does not own. The votaries of short-selling consider it as a desirable and an essential feature of a securities market.

The critics of short selling, on the other hand, are convinced that it, directly or indirectly, poses potential risks and can easily destabilise the market.

"SEBI's new norms are expected to be a market confidence-boosting factor and are aimed at reducing the extreme volatility seen in F&O stocks. This will impact the speculators and could lead to some short covering on Monday,” Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

“For the long term, markets will continue to focus on whether virus infection rates peak out and also on the coordinated actions of RBI and the government to support businesses with relief package,” he said.

In the recent past, global markets have also taken similar measures to curb short selling, while some of them have closed the exchanges (Philippines stock exchange).

Markets across the world have been under pressure as infected cases of Coronavirus exceeded 300,000 globally. In India, many parts of the country are facing a lockdown, a situation which is similar to other nations such as USA, Iran, and Italy.

A lockdown threatens the economic activity of a country; hence, fears of a possible recession has gripped markets. Hence, panic selling is seen in equity markets across the globe. FIIs have pulled out more than Rs 50,000 cr so far from the cash segment of Indian equity markets.

In order to curb the extreme volatility witnessed in the stock market, SEBI has introduced measures such as revising the market-wide position limit to 50 percent which will reduce fresh short positions in individual stocks.

In simple words, no fresh positions will be allowed in the underlying security, once the 50 percent criterion is met. An increase in margin for the cash segment to 40 percent will lead to a higher margin requirement for intraday positions.

Restricting fresh short positions against the underlying security will curb fresh naked short positions in the market. And, restricting long positions only to the tune of available cash and equivalents will reduce the overall speculation in the equity market, suggest experts.

“When other economies are resorting to banning short selling on account of increased volatility, such a move by SEBI should provide some relief on the overall volatility witnessed in the markets and should calm in the markets in the short term,” Vijay Kuppa, Co-Founder, Orowealth said.

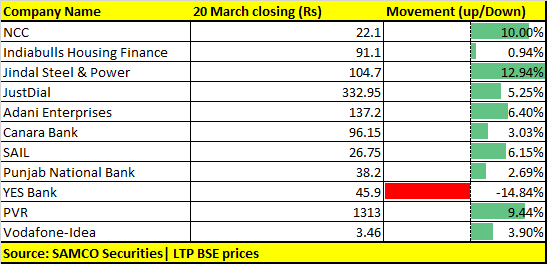

Jimeet Modi, Founder & CEO, Samco Securities is of the view that these are good steps to reduce excessive volatility. The market-wise limits have been reduced which means more stocks likely to go into F&O trading ban period.

“Also there is a practical short-selling cap at 500 crores that’s been levied. If someone wants to speculate beyond prescribed limits of 500 crores, they will need to put up twice the margin which will be blocked for 3 months,” he said.

Modi further added that the impact of this circular would be highest on stocks with the very high volatility that include names like NCC, Jindal Steel & Power, Indiabulls Housing, Canara Bank, Adani Enterprises, Canara Bank, PNB, SAIL, PVR, Vodafone Idea, Just Dial and YES Bank.

Effectively about 10-12% of the F&O stocks would see an impact. For most other stocks, even if MWPL is restricted, open interest is far lower to have any meaningful impact.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!