Alibaba was never a strategic shareholder for Paytm, the fintech’s founder and the chief executive officer said at Davos on January 17. This comes days after the Chinese internet giant sold $125 million worth of shares in the Indian fintech company.

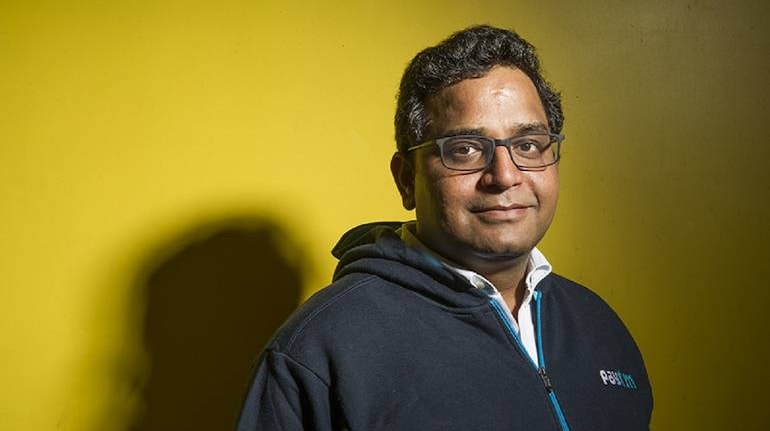

Talking to CNBC TV18 on the sidelines of the World Economic Forum, Sharma said the company was not aware of the sale beforehand — and that it could have been planned better.

"Alibaba was never a strategic shareholder for us. Alibaba and Paytm were never together in the business... The exit could have been planned better, but it is what it is," he said.

While a strategic shareholder has business relations with the investee company, a financial investor makes a bet just for returns.

In 2015, Alibaba and its affiliate company Ant Financial had become the largest shareholders in Paytm when they invested $680 million for over 44 percent equity stake in the company. After selling shares in the Noida-based fintech in its IPO and the recent sale, the duo still owns around 28 percent of Paytm.

Since the fintech unicorn’s listing in November 2021, its shares have lost 75 percent of their value as analysts and investors have questioned its business model, the path to profitability, and the threat from regulatory changes.

The company has told investors earlier that it will attain adjusted EBITDA break-even by the September 2023 quarter. Sharma told CNBC TV18 today that that might happen sooner than expected.

"Focus on what we believe will give us a large profit pool over the long term... We are still at a very early stage in the online payments game. There is a huge organic growth out there for payments with ~100 million merchants of which only 35-40 million are active," he said.

“There is so much to do in India that we're not looking at the rest of the world just yet. Why should we waste our time building for other countries when we can give back to our own country?” he added.

Earlier this month, proxy advisory firm Institutional Investor Advisory Services said in a report that Paytm may be circumventing regulation to grant employee stock options to the founder. While Sharma isn’t classified as a promoter — Indian parlance for controlling shareholder — he has rights akin to one, including a potential permanent seat on the board, IiAS said in a note.

“These provisions and structures give Vijay Shekhar Sharma ‘entrenchment’ similar to that enjoyed by promoter families in the more traditional companies,” IiAS said. It added the regulator must examine Sharma’s move to pare his direct stake by transferring equity to a family trust, barring which he wouldn’t be eligible for the Employee Stock Option Plan.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!