Making money in equity markets is not easy and it gets doubly difficult when there is a fear of recession. India’s growth is at a six-year low and it sent the Sensex and the Nifty hurtling below crucial support levels on September 3.

But, some stocks, including HDFC AMC, Asian Paints, Apollo Hosp and Dr Lal Pathlab, have braved the gloom to consistently hit fresh 52-week highs.

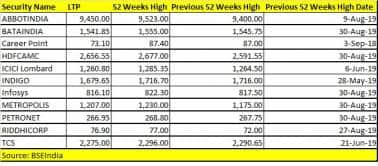

On September 3, too, more than 30 companies hit new highs on the BSE, when the Sensex was down nearly 800 points and Nifty more than 200. Abbott India, Bata India, HDFC AMC, ICICI Lombard, InterGlobe Aviation, Infosys, Petronet LNG and TCS were among the stocks that did well.

So, should one invest in these stocks? Or is the TINA (there is no alternative) factor playing out in favour of some of the stocks? Does it make sense to play the momentum?

The answer lies in appetite for risk, says experts. The fact that most of these stocks have been rallying for some time, the risk-to-reward ratio might not be that attractive.

“TINA along with passive strategies is one of the reasons we are seeing this concentration in the market. So yes, there is a TINA effect since even if there is a stock that is attractive as per valuations in small or midcap with a good growth story, we are not seeing buying coming in,” Mustafa Nadeem, CEO, Epic Research, told Moneycontrol.

“Hence the smallcap and midcap are paying the prices for the same. So, momentum may continue due to TINA or FOMO but it is not necessary they may continue to lead. One has to be cautious,” he said.

But, some stocks do have a good fundamental story and investors can buy them on dips for a long-term perspective, as most of them are leaders in their segments. However, if you are invested then partial profit booking could be done on rallies.

HDFC AMC is one of the best performing life insurance companies posting better AUM for the quarter, while Bata India posted margin led growth.

Dr. Lal Pathlabs reported strong volume performance for the June quarter and is expected to post higher volume and profitability led growth in FY20.

Apollo hospitals, apart from delivering a strong quarter, has guided for debt reduction and stated that it is likely to reduce promoter pledge. Asian Paints and Berger both posted strong revenue and profits (due to lower crude oil prices).

“It wouldn’t be fair to say that TINA factor is playing in some of these stocks, as despite hovering at 52-week highs, most of the companies are leaders in their respective sectors. They have been consistent performers and have good long-term growth prospects going ahead,” Ajit Mishra, Vice President, Religare Broking, told Moneycontrol.

“Nevertheless, we would advise investors to book partial profit, as there might be some consolidation in the near-term given stretched valuations.”

Sumeet Bagadia, Executive Director, Choice Broking, gives a technical outlook on HDFC AMC, Asian Paints, Bata India, Apollo Hospitals and Dr. Lal Pathlabs, which hit a fresh 52-week high in the week gone by:

The stock has performed well in the last one year after listing. The stock is trading above its 21 and 500-days simple moving averages, which show that there is more upside.

On the weekly chart, the stock has been trading in its upward rising wedge formation and is hovering near the breakout zone.

The RSI reading is at 72.43 level and gives positive crossover, apart from this, the RSI has formed symmetrical triangle and also trading above this formation, which points out a positive breath in the counter.

Resistance: 2,600-2,700 Support: 2,100-2,000

The stock is continuously trading in an uptrend and has given a breakout above its horizontal trend line, which is placed at Rs 1,479 that indicates upside movement.

However, the stock has also given a breakout from its descending triangle formation and is now trading above this formation, which may see positive sentiment in the counter.

Resistance: 1,750-1,800 Support: 1440-1400

The stock has started to trade around its all-time high, as the momentum dynamics has shifted to a new zone.

The stock has reached its uncharted territory with ample volume activity, which indicates a favourable condition in which supply can get absorbed by fresh demand. Therefore, we can expect further upside movement.

Resistance: 1,750-1,800 Support: 1,360-1,300

The Pharma Index is not performing these days and it will take time to do so. Apollo Hosp reached its all-time high but the stock is very volatile, and the next resistance level is around Rs 1,550-1,600, and supports are placed at Rs 1,420-1,355.

A moment indicator RSI is also trading sideways, with a negative crossover, which shows that the near-term trend remains bearish.

The stock has been trading near support of its 21-day moving average on the daily chart, which suggest that the stock has a great potential.

Furthermore, the index has been formed a symmetrical triangle and is also trading above this formation which shows positive movement in the counter.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!