India’s largest private thermal power producer with installed capacity of 13,650 MW.

Fundamental Aspects:

In 11 years

Reserves increased 5 times,

Sales increased almost 18 times,

Net profit increased 20 times,

Huge CAPEX for future expansion &

Promoters holding is good 74.97%.

The only concerning parameter is the debt to equity ratio, which is staggering 1.87.

If you compare it with its peers then it is still below average.

This power sector is capital intensive due to their infrastructure requirements.

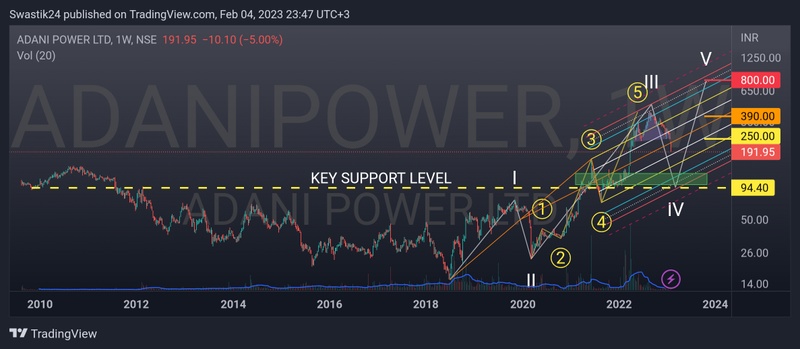

Technical Aspects:

Price fell down from the head & shoulder pattern and its technical target is somewhere around 120 level.

RSI & MACD are confirming more bearishness on multiple timeframes.

Alternatively the price is in 4th cyclical wave (white markers).

Expecting initiation of 5th cyclical wave from green zone highlighted.

Good to accumulate around 100 - 125 levels for the following targets:

Short term swing target @ 250 (120% ROI)

Medium term swing target @ 390 (240% ROI)

Long term positional target @ 800 (600% ROI)

Seems unbelievable!!

1st cyclical wave gave 387% returns in 1 year 4 months &

3rd cyclical wave had given 1780% returns in less than 3 years.

Will update exact targets in future as chart unfolds.

Do your own due diligence before taking any action.

Peace ✌🏻