Leading Indian manufacturer of Speciality Chemicals and Pharmaceuticals with a global footprint.

Chemicals manufactured by Aarti are used in the downstream manufacture of pharmaceuticals,

agrochemicals, polymers, additives, surfactants, pigments, dyes, etc.

Borrowings increased due to increased CAPEX.

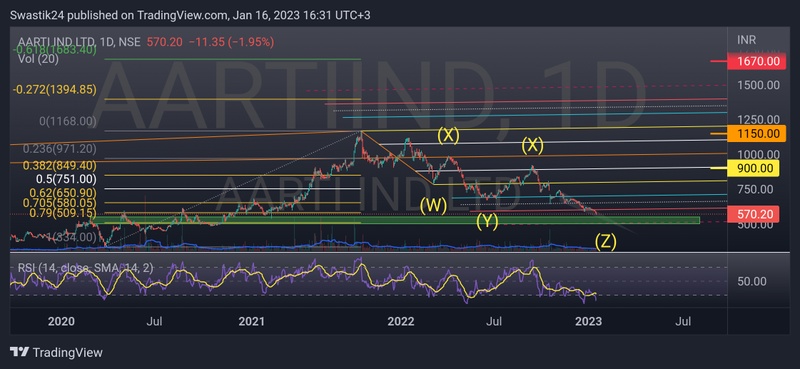

Technically bearish as the price is moving inside an ending diagonal.

It will bottom out once price breaks out upside of this falling wedge highlighted.

Monthly RSI shows strong bullish divergence.

Good to accumulate around 500-550 levels for the following targets:

Medium term swing target @ 900 (70% ROI)

Long term swing target @ 1150 (115% ROI)

Long term positional target @ 1670 (215% ROI)

Do your own due diligence before taking any action.

Peace ✌🏻